Income – Retirement Income

11-1

Income – Retirement Income

Introduction

This lesson will help you identify and report the taxable portion of retirement income received by the

taxpayer. To do this, you must understand the types of retirement income and the forms used to report

them. You should also be able to recognize when taxpayers should adjust their withholding and determine

which form to use.

For more information on the topics discussed in this lesson, see Publication 575, Pension and Annuity

Income; Publication 590-B, Individual Retirement Arrangements (IRAs); Publication 721, Tax Guide to U.S.

Objectives

At the end of this lesson, using your resource materials, you will be able to:

• Identify how retirement income is reported to the taxpayer using Form

1099-R series

• Calculate the

• Determine how to report retirement income on the tax return

• Determine when an adjustment to withholding should be made

What do I need?

Form 13614-C

Publication 4012

Publication 575

Optional:

Publication 590-B

Publication 721

Publication 939

Form 1040 Instructions

Form 1040-ES

Form 1099-R

Form 5329

Form 8606

Form W-2

Form W-4P

Form W-4V

Worksheet

What is retirement income?

from annuities,

etc. Retirement income may be fully or partially taxable. For information

Where can I get information about a taxpayer’s retirement

income?

To determine if the taxpayer must report retirement income, review the taxpayer’s completed intake and

interview sheet, particularly the Income section. If the taxpayer had retirement income, you may need to ask

additional questions to clarify the type of plan, whether the taxpayer’s contributions to the plan were before-

tax or after-tax dollars, etc. This is explained later in this lesson.

Be considerate when probing for the information you need to complete the return. When taxpayers cannot

provide the required information (and have not retained the packet of “retirement papers” they received

when they retired), suggest that they contact their former employer or annuity administrator. You may even

give the taxpayer a written list of questions that need to be resolved.

Income – Retirement Income

11-2

Which forms are used to report retirement income?

Retirement income can be reported on one of the forms in the Form 1099-R Series:

• Form 1099-R,

Insurance Contracts, etc.,

• Form CSA 1099-R, Statement of Annuity Paid (civil service retirement payments),

• Form CSF 1099-R, Statement of Survivor Annuity Paid, and

• Form RRB 1099-R, Annuities or Pensions by the Railroad Retirement Board

If Form 1099-R is for an IRA-type distribution, it will be indicated in Box 7.

Examples of these forms can be found at irs . gov. These forms indicate such information as the amount

received, the taxable portion, and the taxpayer’s cost (investment) in the plan.

income wages on Form 1040 until the minimum retirement age is met. Review the software entries in the Volunteer

Resource Guide, Tab D, Form 1099-R Rollovers and Disability Under Minimum Retirement Age.

What if the taxable portion is already calculated?

In many instances, the payer will compute the taxable portion of the distribution and report the taxable

volunteers because the taxable portion is not shown on the form.

Tax Software Hint: Refer to the Volunteer Resource Guide, Tab D, Income, Form 1099-R Pension

and Annuity Income.

Amounts from Form 1099-R are reported as follows:

• The gross amount (Box 1 of Forms 1099-R, CSA- and CSF-1099-R) should be shown on Form 1040 on

the IRA distributions or Pensions and annuities line

• The taxable amount (Box 2a of Forms 1099-R, CSA- and CSF-1099-R) should be shown on Form 1040

on the IRA distributions or Pensions and annuities line in the taxable amount section

Note: The IRA/SEP/SIMPLE box is not

In-scope Roth IRA distributions are reported on Form 1040 on the IRA distributions line.

Any amount of federal income tax withheld on Forms 1099-R, CSA- and CSF-1099-R should appear in the

Federal income tax withheld from Form(s) 1099 line of the tax return.

Income – Retirement Income

11-3

What if the taxable portion is not calculated?

If the payer did not include the taxable amount on Form 1099-R, CSA- or CSF-1099-R, or if taxpayers have

Form RRB 1099-R, you will need to compute the taxable portion of the distribution. The following will help

you determine the additional information needed to calculate the taxable portion of distributions from IRAs,

pensions, or annuities.

What do I need to know about retirement income distributions?

Retirement plans are funded by either before-tax or after-tax contributions. “Before-tax” simply means that

the employee did not pay taxes on the money at the time it was contributed, i.e., the taxpayer has no cost

basis in the plan. “After-tax” means the employee paid taxes on the money when it was contributed, i.e., the

taxpayer has a cost basis in the plan.

If the taxpayer made all contributions to a plan with before-tax dollars, the entire distribution will be fully

taxable. The funds are taxed at the time of the distribution because neither the contributions nor the

earnings/investment gains were previously taxed. This is common in 401(k) and Thrift Savings Plans.

If the taxpayer did not contribute to the retirement plan, all the distributions are fully taxable.

If the taxpayer made contributions to a plan with after-tax dollars, then the distributions will be partially

taxable. The portion of the distribution that is considered a return of the after-tax dollars will not be taxed

again. It is considered a return of the taxpayer’s cost basis (an amount for which taxes have already been

paid). The portion of the distribution that represents the earnings/investment gains is taxable since it has

employer plan designated Roth account are wholly nontaxable, similar to a Roth IRA.

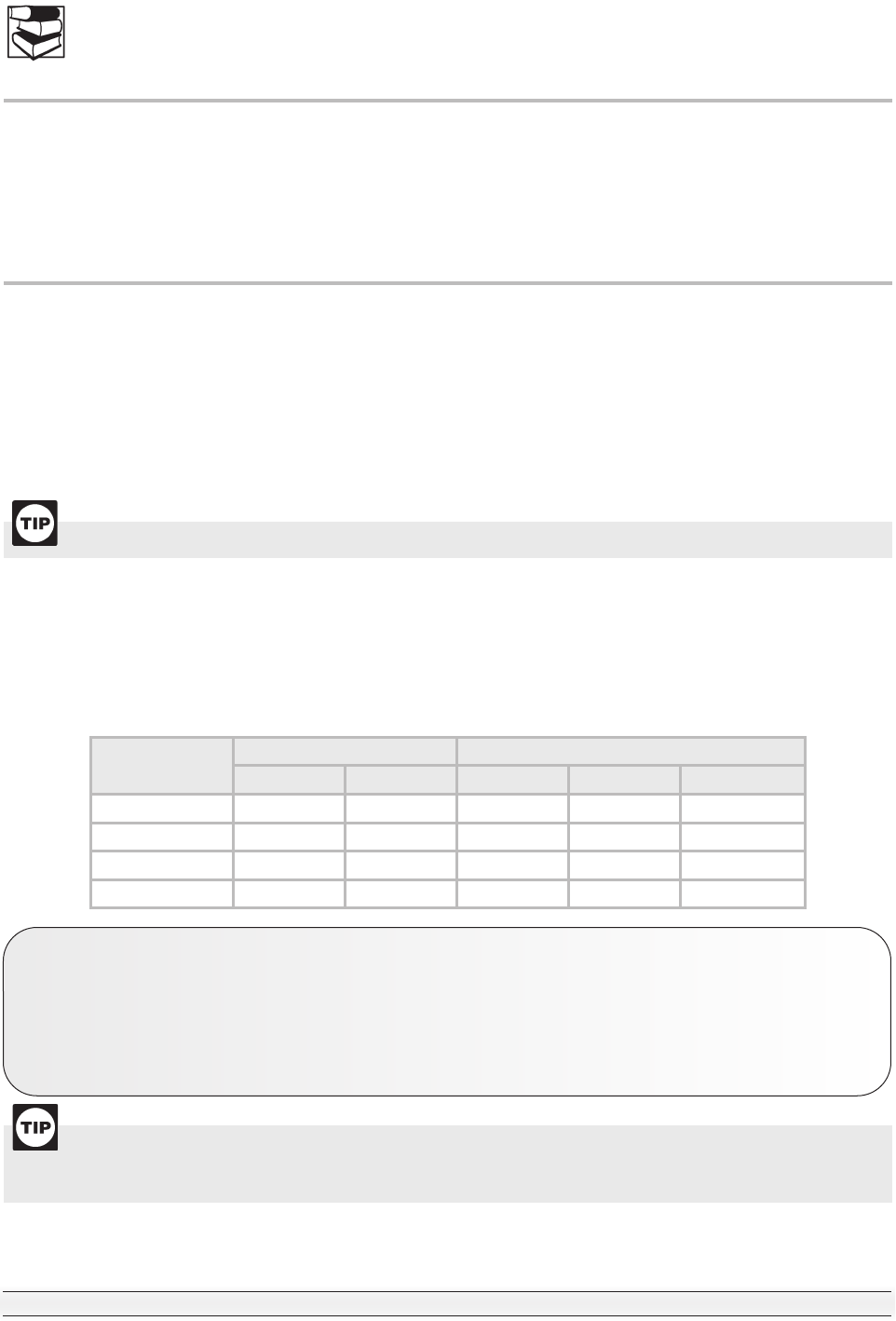

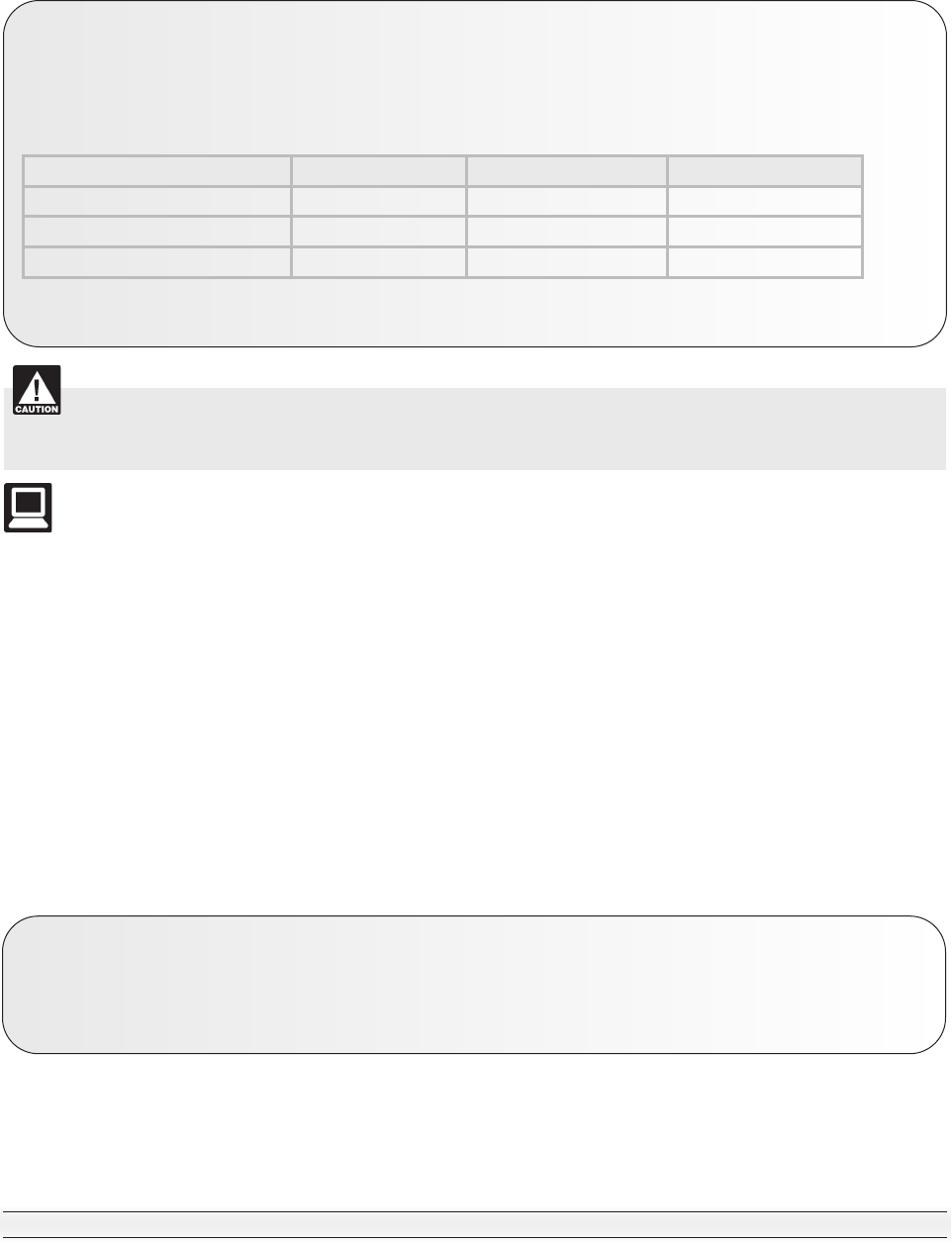

Employee

Contributions

Contributions Taxability of Distributions

Before-Tax After-Tax Fully Partially Nontaxable

No n/a n/a Yes

Yes Yes Yes

Yes Yes Yes

Yes, Roth Yes Yes

Taxpayers may not always understand why they must pay taxes on their retirement income. When this is the

case, take the time to clearly explain what retirement funds are taxed and why. It is usually a good idea to question

taxpayers about the nature of their contributions to ensure that they will not be taxed twice on the same funds.

example

Mark retired after working 30 years for a construction company. Each week, he contributed to the

Carpenter’s Pension Plan. Every year, Mark paid tax on the gross amount of his salary, including his

pension contribution. This means his pension contributions were made with dollars that had already

been taxed. Now that he is receiving payments from the pension, he will not be taxed on the portion that

represents his contribution; he will be taxed on the portion that represents earnings.

Income – Retirement Income

11-4

How do I nd the taxable portion of IRA income?

Individual Retirement Arrangements

IRA distributions are reported on Form 1099-R. Earnings and investment gains in a taxpayer’s IRA generally

accumulate tax free or tax deferred until they are withdrawn as fully or partially taxable distributions. There

• Traditional IRA

• Roth IRA

• Savings Incentive Match Plans for Employees (SIMPLE) IRA

•

Traditional IRA

Distributions from traditional IRAs are fully taxable unless nondeductible contributions have been made.

See the Adjustments lesson for additional information. Form 8606, Nondeductible IRAs, is used to keep

track of nondeductible contributions. Taxpayers who made nondeductible contributions should be referred to

a professional tax preparer.

between “contributions” and “deductions.” Simply put, contributions are the amounts deposited into an IRA account,

and deductions are the portion of the contribution that is deducted on the tax return. The deductible portion may be

less than the amount allowed as a contribution.

example

will pay income tax on the distributions he receives, which represent the contributions he made and

deducted, as well as the earnings on these contributions over the years.

Roth IRA

•

and

• The distribution is:

○ Made on or after age 59½, or

○ Made because the taxpayer was disabled, or

○

○

The 5-year rule applies to each Roth conversion and rollover. See Publication 590-B.

Only code Q is in scope for the VITA/TCE programs. See instructions for code Q in the

Volunteer Resource Guide, Tab D, Income. For rules on converted Roth IRAs, see Publication 590-B.

Income – Retirement Income

11-5

Nonqualied Distributions

Savings Incentive Match Plans for Employees (SIMPLE) IRA

their pay to an IRA as part of a SIMPLE plan. The employer is also generally required to make contributions

on behalf of eligible employees. Generally, SIMPLE IRA contributions are not included in an employee’s

income when paid into an IRA, and the distributions are fully taxable when the employee receives them in

later years.

Simplied Employee Pension (SEP) IRA

part of their pay to an IRA as part of a SEP plan. Generally, SEP IRA contributions are not included in an

employee’s income when paid into the IRA. Because of this, distributions are generally fully taxable when

the employee receives them in later years.

EXERCISES

Answers follow the lesson summary.

Question 1: Distributions from all IRAs discussed in this topic are fully taxable with the exception of the

Roth IRA. True False

Question 2: Mary opened a Roth IRA 3 years ago. This year, she took the full amount of her Roth IRA

income. True False

Question 3: Amy contributed to a Roth IRA for 5 years. In year 6 (at age 60), she took a distribution

from her IRA. The entire distribution is excluded from her taxable income.

True False

How are IRA distributions reported?

Traditional IRA

If IRA/SEP/SIMPLE is checked on Form 1099-R, ask the taxpayer:

• Was this a distribution from a traditional IRA?

• Were the contributions deducted from income in the year they were made?

If so, the entire distribution is taxable. Report the distributions on Form 1040. If not, the distribution is

partially taxable and Form 8606 is required. In that case, the return is out of scope.

An early distribution from a traditional or Roth IRA may be subject to a 10% additional tax. Refer to the Other

Taxes lesson for more information.

Income – Retirement Income

11-6

SIMPLE and SEP IRAs

Distributions from SIMPLE and SEP IRAs are in scope for VITA/TCE, because they are taxable and are

generally reported on the return just like taxable traditional IRA distributions.

penalty. If this is applicable, Form 1099-R will be issued with distribution code S. If an exception to the

penalty applies, complete Form 5329 as you would do with traditional IRA distributions.

Roth IRA

Distributions from a Roth IRA are not taxable as long as they meet all the criteria discussed previously. If

the distribution does not meet the criteria, then all or part of the funds MAY be taxable; refer the taxpayer to

a professional tax preparer.

How are rollovers handled?

Generally, a rollover is a tax-free distribution to the taxpayer from one retirement account (traditional IRA or

by the institution to another institution, it will show distribution code G. If there is also a taxable amount in

Box 2 of the 1099-R, the distribution may be partially or fully taxable.

If the taxpayer indicates that a rollover occurred but the distribution code is NOT G, then the taxpayer must

have re-deposited the full amount into an appropriate account within 60 days. If this was not done, the

distribution may be partially or fully taxable; refer the taxpayer to a professional tax preparer unless the self-

Note:

tax-free into other SIMPLE IRAs. Taxable SIMPLE IRA rollovers are out of scope for VITA/TCE.

transfer funds from one IRA trustee directly to another because such a transfer is not a rollover.

What about a rollover from a Roth IRA?

Most of the rules for rollovers to traditional IRAs apply to Roth IRAs. Generally, a withdrawal of all or part of

the assets from one Roth IRA and a contribution to another Roth IRA within 60 days is tax free. A rollover

from a Roth IRA to an employer retirement plan is not allowed.

If there is a direct rollover of a designated Roth account distribution to a Roth IRA, the distribution code for

may be taxable; refer the taxpayer to a professional tax preparer.

A conversion of a traditional IRA to a Roth IRA, and a rollover from any other eligible retirement plan to a

Roth IRA, made after December 31, 2017, cannot be recharacterized as having been made to a traditional

IRA.

Tax Software Hint: Additional information must be entered for retirement account rollovers. Refer to

the Volunteer Resource Guide, Tab D, Income, Form 1099-R.

from employment. Instead of the usual 60-day rollover period, the taxpayer has until the due date, including

rollover.

Income – Retirement Income

11-7

What is the IRA self-certication procedure?

Procedure Helps People Making Retirement Plan Rollovers

Revenue Procedure 2016-47

retirement plan distributions who inadvertently miss the 60-day time limit for properly rolling these amounts

into another retirement plan or individual retirement arrangement (IRA). Eligible taxpayers can qualify for

a waiver of the 60-day time limit and avoid possible taxes and penalties on early distributions, if they meet

certain circumstances. Taxpayers who missed the time limit will ordinarily qualify for a waiver if one or more

of 11 circumstances, listed in the revenue procedure, apply:

•

• The distribution was in the form of a check and the check was misplaced and never cashed.

• The distribution was deposited into and remained in an account that the taxpayer mistakenly thought

was a retirement plan or IRA.

• Taxpayer’s principal residence was severely damaged.

• One of the taxpayer’s family members died.

• Taxpayer or a family member was seriously ill.

• Taxpayer was incarcerated.

• Restrictions were imposed by a foreign country.

• A postal error occurred.

• The distribution was made on account of an IRS levy and the proceeds of the levy have been returned.

• The party making the distribution delayed providing information that the receiving plan or IRA required

• The distribution was made to a state unclaimed property fund (Revenue Procedure 2020-46).

qualify for a waiver under these 11 circumstances. Even if a taxpayer does not self-certify, the IRS now has the

authority to grant a waiver during a subsequent examination. Other requirements, along with a copy of a sample self-

The IRS encourages eligible taxpayers wishing to transfer retirement plan or IRA distributions to another

retirement plan or IRA to consider requesting that the administrator or trustee make a direct trustee-to-

trustee transfer, rather than doing a rollover. Doing so can avoid some of the delays and restrictions that

often arise during the rollover process.

For more information, refer to Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs).

EXERCISES (continued)

Question 4: Andrew changed jobs and received Form 1099-R from his previous employer. The gross

days of receiving the check (rollover).

Which of the following statements is true?

A. The entire distribution is includible as income

B. The entire distribution is excludable from income

C. The distribution is eligible for the ten-year tax option

D. The distribution is eligible to be taxed at a special rate

Income – Retirement Income

11-8

Qualied Charitable Distributions

of the IRA to an organization eligible to receive tax-deductible contributions. The taxpayer must be at least

Enhancement (SECURE) Act, the long-standing 70½ age limit for making contributions to traditional IRAs

was eliminated for tax years beginning after 2019. In addition, the excludible portion of a QCD distribution

is reduced by IRA deductions once the taxpayer attains age 70½. The taxpayer must have the same type

of acknowledgement of the contribution that is needed to claim a deduction for a charitable contribution.

Typically, a QCD counts towards the taxpayer’s required minimum distribution (RMD).

is included in income as any other distribution. On a joint return, the spouse can also have a QCD and

If a QCD is reduced by an IRA contribution, the taxpayer will show that amount as a taxable distribution.

Additionally, the taxpayer may claim a charitable contribution deduction for the donation.

How do I nd the taxable portion of pensions and annuities?

Fully Taxable Pensions and Annuities

Pension and annuity income is reported on Form 1099-R, Form CSA 1099-R, and Form RRB 1099-R. In

general, pension or annuity payments are fully taxable, if the following is true:

• Taxpayers did not pay any part of the cost of their pensions or annuities

• Employers did not withhold part of the cost from the taxpayers’ pay while they worked

• Employers withheld part of the cost from the taxpayer’s before-tax pay while they worked

covered in a later lesson.

Partially Taxable Pensions and Annuities

preparer.

Three-Year Rule was used.

example

Sue worked for a software development company for 20 years. She retired and began receiving pension

income the same year. Sue never contributed to the pension plan while she was working; her employer

Income – Retirement Income

11-9

of monthly payments is based on the taxpayer’s age (and the spouse’s age if a joint/survivor annuity is

selected by the taxpayer) on the annuity start date. This calculation is not changed for subsequent events,

such as divorce, marriage or death.

Taxpayer’s

To ensure the taxable portion of the pension is calculated correctly, the age of the taxpayer(s) at the annuity

start date, not their age for the tax year, must be used when determining the total number of expected monthly

payments.

Tax Software Hint: Refer to the Volunteer Resource Guide, Tab D, Income, Form 1099-R for more

Be sure to include any amount of federal income tax withheld on Form 1099-R in the Federal income tax

withheld from Forms W-2 and 1099 line of the tax return.

information:

• The cost in the plan (total employee contribution on Form 1099-R)

• The taxpayer’s age on the date the annuity began (and the spouse’s age if joint/survivor annuity is

selected); note if the annuity starting date is before or after the taxpayer’s birthday for that year

• Total of tax-free amounts from previous years, available from the taxpayer’s prior year worksheet

If the taxpayer has more than one Form 1099-R that is not fully taxable, calculate the tax-free portion for

each form separately.

example

Melvin retired from a manufacturing plant. While he was working at the plant, his employer withheld

money from each paycheck and sent it to the Engineer’s Pension Fund. Melvin will receive a monthly

the tax-free part of monthly payments.

example

Joe Mary Combined

Date born 3/5/1950 7/23/1953

Date annuity started 7/1/2015 7/1/2015

Age when annuity started 65 61 126

Note: Mary had not reached her 62nd birthdate by the day the annuity started.

Income – Retirement Income

11-10

Disability Pension Income

Generally, taxpayers who retire on disability must include all of their disability payments in income.

Disability payments are taxed as wages until the taxpayer reaches the minimum retirement age

– this age is set by the employer. After the taxpayer reaches the minimum retirement age, disability

payments are treated as pension income to determine taxability.

Taxpayers are considered disabled if they cannot engage in any substantial gainful activity because of any

medically determinable physical or mental condition that can be expected to result in death or to be of long-continued

Minimum retirement age is generally the earliest age at which taxpayers may receive a pension, whether or

not they are disabled.

Employers may report disability income on one of the following forms:

• Form W-2, if the taxpayer has not reached the minimum retirement age set by the employer

• Form 1099-R, if the taxpayer has reached the minimum retirement age

regardless of the taxpayer’s age. You must conrm the employers’ minimum retirement age. If the taxpayer is

as wages

taxpayer’s ability to make an IRA contribution.

Tax Software Hint: If Form 1099-R, Box 7, indicates a distribution code 3, and the taxpayer is on

disability but under retirement age, check the box stating the taxpayer is disabled. The tax software will

place the amount on Form 1040 as wages, rather than on the pension line.

Refer to the Volunteer Resource Guide, Tab D, Income, Form 1099-R for more information on how to report

disability pay to ensure it is reported on the correct line of Form 1040.

EXERCISES (continued)

Question 5:

Income – Retirement Income

11-11

EXERCISES (continued)

Question 6:

a tractor-trailer company, a large box fell on her and left her paralyzed. She receives a monthly

disability income on her Form 1040?

A. Estimated tax payments and amount applied from return

B. Pensions and annuities

C. Taxable pensions and annuities

D. Wages

Retired Public Safety Ocers

from a government retirement plan to the provider of accident, health, or long-term disability insurance. A

and Annuity Income, for more information.

Tax Software Hint: If the taxpayer is eligible for the exclusion, refer to the Volunteer Resource Guide,

Tab D, Income, Form 1099-R.

What other retirement income issues are there?

There are a few other issues related to reporting retirement income that you may encounter. Some of the

following distributions are subject to various additional taxes that are computed on Form 5329, Additional

the additional tax does not apply.

Only the exceptions for early distributions not subject to the additional tax (Part I of Form 5329) are included

in scope for the VITA/TCE training. Refer taxpayers who must complete other information on Form 5329 to

a professional tax preparer. Form 5329 and exceptions are covered in the Other Taxes lesson.

Lump-Sum Distributions

A lump-sum distribution is the distribution or payment within one tax year of an employee’s entire balance

does not include certain deductible voluntary employee contributions and certain amounts forfeited or

subject to forfeiture. Distributions from IRAs or tax-sheltered annuities do not qualify as lump-sum distributions.

the payment must have been made:

• Because the plan participant died, or

• After the participant reached age 59½, or

• Because the participant (not including a self-employed individual) separated from service with the

employer, or

• After the participant, if self-employed, became totally and permanently disabled

Income – Retirement Income

11-12

Lump-sum distributions are reported on Form 1099-R like any other pension distribution. Some lump-sum

distributions qualify for special tax treatments. If Form 1099-R indicates a distribution code of A, it is a lump-

sum distribution qualifying for special tax treatments. Taxpayers with this situation should be referred to a

professional tax preparer.

Early Distributions

An early distribution is a withdrawal from a retirement fund by a taxpayer who is under age 59½. Early

distributions can be subject to an additional 10% tax. The additional tax applies to the taxable portion of the

distribution or payment.

Certain early distributions are not subject to the early distribution tax. When the distribution code on Form

1099-R is 1, the taxpayer will not be subject to the additional 10% tax if an exception applies.

If the distribution code is 2, 3, or 4, the taxpayer does not have to pay the additional tax. The exceptions for

excluding early distributions, from the additional tax are covered in more detail in the Other Taxes lesson.

Minimum Distributions

To avoid an additional tax for excess accumulation, participants in retirement plans must begin taking a

2020), or retired, whichever is later. For IRAs, it does not matter whether the taxpayer has retired. These

time to begin their RMD.

After the starting year for RMDs, taxpayers must receive the minimum distribution for each year by

December 31 of that year. (The starting year is the year in which the taxpayer reaches 72, 70½ before

minimum distributions for two years must be received the following year, one of which must be taken by

April 1.

beyond the scope of the VITA/TCE programs. Refer taxpayers to their trustee if they have questions.

If the taxpayer does not receive the minimum distribution, an additional tax may be imposed. The tax is 50% of

example

Income – Retirement Income

11-13

This information is provided for your information only, to help you answer any questions a taxpayer may

ask about RMD. RMD distributions are reported on Form 1099-R and included on the return using the

procedures previously discussed.

Withdrawal of Excess IRA Contributions

An excess IRA contribution is the amount contributed to a traditional and/or Roth IRA during the year that is

more than the smaller of the:

• Maximum IRA amount for the year based on the taxpayer’s age, or

• Taxable compensation for the year

The taxpayer may not know that a contribution is excess until the tax return is completed after the end of

the year. In this situation, the excess amount, with any earnings on that amount, must be withdrawn by the

due date of the return (including extensions). If the excess amount is not withdrawn by the due date of the

return, the taxpayer will be subject to an additional 6% tax on this amount, and the return is out of scope .

The withdrawn excess contribution is not included in the taxpayer’s gross income if both of the following

conditions are met:

• No deduction was allowed for the excess contribution

• All interest or other income earned on the excess contribution is withdrawn by the due date of the

return, including extensions

income is reported on the return for the year in which the excess contribution was made. The withdrawal of

interest or other income may also be subject to an additional 10% tax on early distributions.

If the taxpayer is subject to an additional tax due to excess IRA contributions, refer them to professional tax

preparer.

example

Myrna was 72 when she retired in 2018. She was required to begin taking minimum distributions from

her traditional IRA by April 1 of the year following the year she turned 70½ even though she had not

retired. Myrna had to take a second required distribution by December 31 of the same year.

example

EXERCISES (continued)

Question 7: Taxpayers who withdraw excess contributions and earnings on the excess contributions

by the due date of the tax return are not subject to an additional 6% tax on the excess contribution.

True False

Question 8:

A. Take a distribution by December 31, 2020.

B. Take a distribution by April 1, 2021.

C. Take a distribution by December 31, 2021.

D. Take a distribution by April 1, 2022, and another by December 31, 2022.

Income – Retirement Income

11-14

What retirement distributions qualify for tax-favorable treatment?

Special Provisions and Tax-Favorable Treatment of Retirement Fund Distributions

on early distributions; distributions may be included in income over a 3-year period; and, to the extent the

distribution is eligible for tax-free rollover treatment, the distribution may be recontributed. If the retirement

spread and permitted recontributions need to be reported on Form 8915-F.

What are the rules for the 3-year spread of eligible distributions?

A taxpayer who elected to include designated coronavirus-related distributions in income ratably over a

will report the taxable distribution equally, 1/3 in each year 2020, 2021, and 2022. The election to opt out

extensions) for the year of the distribution.

What are the rules for recontributions of eligible distributions?

the amount of the distribution. Recontribution is permitted whether or not the 3-year spread is elected.

The recontribution must be completed within three years beginning with the day after the date that the

distribution was received.

Not all coronavirus-related distributions may be repaid. That is, a distribution that is eligible for the 3-year

spread may or may not be eligible for recontribution. In general, distributions that would be eligible for

tax-free rollover treatment are eligible for recontribution under the CARES Act. The following distributions

are not eligible for recontribution:

1. Any coronavirus-related distribution (whether from an employer retirement plan or an IRA) paid to a

the employee or IRA owner).

2. Any distribution (other than from an IRA) that is one of a series of substantially equal periodic payments

made (at least annually) for:

a. A period of 10 years or more,

b. The individual’s life or life expectancy, or

c.

A pension is a periodic payment and cannot be repaid, even if the taxpayer elects to use the 3-year spread

of the income.

is anticipated that eligible retirement plans will accept recontributions of coronavirus-related distributions,

will not be treated as a rollover contribution for the one-in-12-months limitation.

Income – Retirement Income

11-15

How are these provisions reported on a tax return?

• All their distributions and their designated coronavirus-related distributions,

• Whether they opt out of the 3-year spread for their eligible distributions,

•

of the return, including extensions), and

• The amount of their designated coronavirus-related distributions taxable in 2020.

that has been repaid for the year, if any, and the taxable amount of their designated coronavirus-related

distributions if the 3-year spread was elected. A repayment is applied to the current tax year’s ratable

If the repayment exceeds the current tax year’s ratable taxable amount (if any), the taxpayer can elect to

amended Form 8915-E or 8915-F for that prior year to receive a refund of tax they paid. A repayment made

year.

Taxpayer Interview and Tax Law Application

example

employer’s 401(k) plan. She can choose to recontribute the distribution to her employer’s plan, if

the plan allows, or to recontribute the distribution to her IRA. The employer plan administrator or IRA

SAMPLE INTERVIEW

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

VOLUNTEER SAYS… JAMES RESPONDS…

I see in your 2020 return that you elected to spread

your retirement distribution over three years.

Yes, I had to take extra money out of my IRA.

Being able to spread the tax seemed like a

good idea.

Form 8915-E shows the amount of distribution of

$45,000. Is that right? Which means $15,000 will be

taxable in 2021.

Yes, that’s right.

You also have the ability to repay or recontribute

some or all of the distribution. If you do so, you

can reduce the amount taxable in 2021 for any

repayments made after you led your 2020 return up

through the day you le your 2021 return. Did you

make any recontributions during that time or do you

plan to do so before we le your 2021 return?

I would like to, but cash is a little tight right now.

Can I recontribute it next year?

Yes. You have until three years from the day after

the date your took the money out of your IRA. If you

recontribute more than the 1/3 that is taxable for

that year, an amended return may be needed as the

excess can be carried back to a year already led

Ok. Sounds good. I’ll double check the date

I took the distribution and keep track of any

recontributions I make.

Income – Retirement Income

11-16

What is not in scope?

Disaster-related distributions that are not coronavirus-related distribution are out of scope. For more

information, refer to:

• Disaster Assistance and Emergency Relief for Individuals and Businesses at: (https://www.irs.gov/

businesses/small-businesses-self-employed/disaster-assistance-and-emergency-relief-for-

individuals-and-businesses)

•

2018 – December 20, 2019) (https://www.irs.gov/pub/irs-pdf/p5396.pdf)

•

1099-R (https://www.irs.gov/pub/irs-pdf/p5396a.pdf)

• Publication 5396-B, Tax Counseling for the Elderly Casualty Loss Screening Tool (https://www.irs.gov/

pub/irs-pdf/p5396b.pdf)

How do I determine when an adjustment to withholding should be made?

their withholding and estimated tax options with them. This is covered in more detail in the Completing the

Return lesson.

Sometimes taxpayers are not aware they can request that federal income tax be withheld from their

form is sent to the payer. Also, Form W-4V, Voluntary Withholding Request, is used to request withholding

SSA.

example

example

income in 2021.

Income – Retirement Income

11-17

Taxpayers who receive a very large refund may make better use of their funds if tax withholding is lowered.

Explain ways they can reduce their withholding.

For additional help, taxpayers can refer to Publication 17, Withholding, Form W-4, or visit the IRS website

and use the “Tax Withholding Estimator.” A taxpayer who chooses not to have tax withheld may have to

pay estimated tax each quarter. Failure to pay enough federal income tax throughout the year can result

in a large amount of tax being owed when the return is due. It can also result in a penalty. Form 1040-ES,

Estimated Tax for Individuals, is used to calculate the estimated quarterly payment and provides vouchers

with which to remit the payments.

Summary

This lesson helped you identify, calculate, and report the taxable portion of retirement income received by

the taxpayer. It reviewed the types of retirement income and the forms used to report them. You learned

when taxpayers of retirement age are required to take a minimum distribution from a retirement plan and

when they may need to adjust their withholding.

What situations are out of scope for the VITA/TCE programs?

The following are out of scope for this lesson. While this list may not be all inclusive, it is provided for your

awareness only.

•

• Taxpayers who made nondeductible contributions to a traditional IRA

• Taxpayers subject to additional tax due to excess IRA contributions

•

• IRA rollovers that do not meet the tax-free requirements

•

years

• Form 1099-R, distribution code A (lump-sum distribution qualifying for special tax treatments)

EXERCISES (continued)

Question 9:

that she will pay the amount, but wants to know if there is some way to have more tax withheld from

her pension so that she doesn’t owe so much at the end of the year. Which form should she complete

to increase the withholding from her pension?

A. Form W-4P

B. Form W-4V

C. Form W-4R

Income – Retirement Income

11-18

You may not be able to complete the entire exercise if some of the technical issues in the exercise are not

covered until later lessons in the training. In these instances, complete as much of the exercise as you can.

EXERCISE ANSWERS

Answer 1: False. In addition to Roth IRAs, nondeductible contributions to traditional IRAs are also not

taxed when they are distributed.

Answer 2: False. Mary’s distribution was not made after the 5-year period beginning with the rst

taxable year she made a contribution to her Roth IRA. Therefore, the earnings/investment gains portion

of the distribution will be taxable income. (She may also owe an additional tax on early distributions.

This will be discussed in the Other Taxes lesson.)

Answer 3: True. Amy’s distribution can be excluded from her taxable income because it was made

more than ve years after the beginning of the taxable year of her rst contribution, and it was made on

or after age 59½.

Answer 4: B. Andrew can exclude the entire distribution from income because it was rolled over into an

IRA within the allowed 60-day period.

Answer 5: C. Dotty’s entire pension amount of $10,074 (6 x $1,679) is fully taxable because she has

never paid income taxes on her employer’s contribution to her pension.

Answer 6: D. Because Annie Jo has not reached the minimum retirement age set by her employer, you

should report her disability income as wages on her Form 1040.

Answer 7: True. Taxpayers must withdraw excess contributions and any earnings by the due date of

the return (including extensions) to avoid the additional 6% tax on the excess contribution.

Answer 8: D. Taxpayers are required to begin receiving distributions from their qualied plan by April 1

of the calendar year following the year in which they reach age 72. Helen will turn 72 in 2021. She must

take a distribution by April 1, 2022, and another distribution by December 31, 2022.

Answer 9: A. Generally, Form W-4P, Withholding Certicate for Periodic Pension and Annuity

Payments, is used to request a change in withholding on a pension.

TAX LAW APPLICATION

To gain a better understanding of the tax law, complete the practice return(s) for your course of study

using the Practice Lab on L<.